Table of Contents

ToggleAs a journalist covering employment rights and workplace policy, I’ve seen how statutory changes can cause confusion, especially when they affect something as personal and important as maternity leave. With the UK government confirming changes to Statutory Maternity Pay (SMP) for 2026–2027, I decided to break down exactly what’s changing, why it matters, and what both employees and employers need to be prepared for.

After speaking with employment law experts, reading updated guidance, and hearing stories from women planning their maternity leave, I’ve pulled together the facts with real-life context. Here’s everything you need to know about statutory maternity pay in 2026, including the new weekly rate, eligibility rules, and how the changes compare with previous years.

What Is Statutory Maternity Pay and Why Is It Changing in 2026?

Statutory Maternity Pay (SMP) is the legal minimum payment that employers in the UK must provide to eligible employees when they take maternity leave. It supports working mothers by offering a financial safety net during the time they step away from their jobs to care for a newborn.

Each year, the government reviews and adjusts statutory payments to reflect inflation, national wage growth, and broader economic conditions. From April 2026, new rates will apply as part of the annual uplift in statutory benefits.

But this year, the updates go beyond just a higher number; they reflect a continued effort to strengthen the position of working mothers in the modern UK workforce.

How Much Will Statutory Maternity Pay Be in 2026–2027?

The Statutory Maternity Pay for 2026–2027 will see a small but important increase, confirmed by the UK government and outlined in official communications from the Chartered Institute of Payroll Professionals (CIPP).

Here’s the breakdown of how SMP works in the new tax year:

- For the first 6 weeks, you receive 90% of your average weekly earnings (AWE).

- For the remaining 33 weeks, you receive £194.32 per week or 90% of your AWE, whichever is lower.

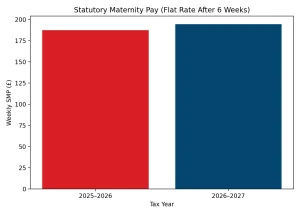

This flat-rate weekly payment has been increased from £187.18 in 2025–2026 to £194.32 for 2026–2027.

“It may not seem like a massive jump, but when you stretch that over 33 weeks, the increase adds up, especially for families already balancing rising living costs,” I shared during a recent interview on workplace legislation.

Let’s take a closer look at the change in statutory rates:

Comparison Table: Statutory Maternity Pay Rates

| Tax Year | Weekly SMP (flat rate after 6 weeks) | Total Duration Covered |

| 2025–2026 | £187.18 | Up to 39 weeks |

| 2026–2027 | £194.32 | Up to 39 weeks |

This change adds £234.30 across the 33 flat-rate weeks compared to last year’s money, which makes a tangible difference during maternity leave.

Who Will Be Eligible for Statutory Maternity Pay in 2026?

The eligibility rules for SMP remain largely the same in structure but will be affected by updates to income thresholds and the rising Lower Earnings Limit (LEL).

To qualify for SMP in 2026, an employee must:

- Have worked continuously for the same employer for at least 26 weeks by the end of the 15th week before the baby is due

- Earn at least £129 per week on average (this is the new LEL, up from £125)

- Be on the employer’s payroll with sufficient National Insurance contributions

- Provide notice of maternity leave and submit a valid MATB1 certificate

The increase in the Lower Earnings Limit means that some previously ineligible part-time workers or lower earners may now qualify for SMP encouraging step towards broader maternity rights.

How Will Statutory Maternity Pay Be Paid in 2026?

Employers remain responsible for processing and paying SMP through their usual payroll systems. SMP is subject to Income Tax and National Insurance, and is paid in the same way as wages.

The process typically works as follows:

- You give your employer the MATB1 certificate and inform them of your intended leave date.

- Your maternity leave (and pay) can begin up to 11 weeks before the expected week of childbirth.

- Payment usually starts from the beginning of your maternity leave and continues for up to 39 weeks.

Employers must keep detailed records of payments and can usually reclaim 92% of SMP from HMRC, or 103% if they qualify as a small employer under the Small Employers’ Relief scheme.

What Changed with the SMP Calculation for 2026?

The core calculation method for SMP remains the same. You’re entitled to:

- 90% of your average weekly earnings for the first 6 weeks

- Then either £194.32 per week, or 90% of your earnings, whichever is lower, for the remaining 33 weeks

What has changed is the weekly cap on this second phase and the earnings threshold. This means employees on the lower end of the income scale may now qualify where they didn’t before, while higher earners continue to see a capped payment.

How Does the 2026 Change Affect Workers Like Julie?

Let me give you an example of how these new rules would work in practice.

Julie, a colleague of mine, works full-time, earning £500 per week. She’s planning to go on maternity leave in July 2026 and meets all eligibility requirements.

Here’s how her pay would break down:

- First 6 weeks:

90% of £500 = £450 per week - Next 33 weeks:

Since 90% of £500 = £450, which is more than £194.32, she’ll receive the flat rate of £194.32 per week

Over her maternity period, she’ll receive around £7,912.56 in SMP payments, not including her first six weeks.

Julie was surprised when we did the maths together. She had assumed she might receive more during the 33-week phase, but the cap applies across the board, something many expecting parents don’t realise until they plan in detail.

Why Are These Changes Happening Now?

The changes to statutory maternity pay in 2026 are part of a broader government effort to align benefits with the current economic landscape. Inflation, wage growth, and cost of living all feed into the Department for Work and Pensions’ decision to update payment rates annually.

In parallel, Statutory Sick Pay (SSP) is also being reformed. The weekly SSP will rise to £123.25, and proposals include changes to eligibility from day one, a move that, if passed, may have further impact on how we assess earnings and statutory entitlements in future.

You can find further details in the CIPP’s report on new statutory payment rates for 2026–27.

What Should Employers and Startups Know About SMP in 2026?

If you’re running a startup or SME in the UK, the annual rise in SMP adds pressure to financial planning, but it’s also a legal obligation. The good news is that HMRC provides support mechanisms to reclaim most or all of the cost.

Employers should ensure:

- Their payroll systems are updated to reflect the £194.32 flat rate

- HR policies and handbooks are revised to reflect new eligibility thresholds

- Employees are informed clearly and early about their maternity rights

It’s also important to factor in the administrative timelines. Maternity leave and pay must be requested in advance, and late communication can lead to errors or disputes.

Is There Any Flexibility With Statutory Maternity Pay?

SMP is structured and fairly rigid, but employees have the right to return to work early, take Shared Parental Leave (if eligible), or use Keeping in Touch (KIT) days to stay connected during their time off.

What SMP doesn’t cover is enhanced maternity pay. That’s something some larger employers offer, topping up SMP with additional income or benefits. But even in 2026, this remains discretionary, not a legal requirement.

Final Thoughts: Why Understanding These Changes Matters

The shift in statutory maternity pay 2026 reflects a continuing effort to keep maternity rights in step with real-world earnings and inflation.

Whether you’re planning for a new baby or reviewing payroll systems for your business, the updated SMP rules are more than just a statutory box-tick; they’re part of creating a fairer, more supportive working environment.

As someone who writes about employment policy and hears from mothers navigating this system, I can say one thing clearly: being informed is your strongest asset.

For the most up-to-date information and calculators, visit the official GOV.UK Statutory Maternity Pay page

What Are the Most Frequently Asked Questions About SMP 2026?

Will the SMP rate definitely be £194.32 in April 2026?

Yes, that’s the confirmed figure, though it’s still subject to final Parliamentary approval. Barring rare reversals, it will go into effect from April 2026.

Can someone qualify if they earn just above the LEL?

Yes. As long as you earn at least £129 per week during the qualifying period and meet other criteria, you’re eligible.

What if the baby arrives early?

If the baby is born earlier than expected, SMP will begin the day after the birth, even if the planned start date was later.

Can SMP be combined with Shared Parental Pay?

Not directly. SMP is specifically for the mother, while Shared Parental Pay allows parents to share leave and pay after the first two weeks.

Do all employers need to offer SMP?

Yes, if the employee qualifies. Even small businesses are legally required to pay SMP and can reclaim it from HMRC.

Is maternity allowance the same as SMP?

No. Maternity Allowance is for those who don’t qualify for SMP, such as self-employed workers or those with insufficient earnings or service.

What happens after the 39 weeks of SMP end?

Employees may continue on unpaid maternity leave for up to 13 additional weeks, completing the full 52-week entitlement.