Table of Contents

Toggle🔍 2026 State Pension Update: When Will You Get Paid?

The DWP has confirmed the phased move to age 67 begins soon. Here is the vital info for those born in 1960 and 1961:

- ✓

The 2026 Shift: Age rises from 66 to 67 starting April 6, 2026. - ✓

Who is Affected? Primarily those born 6 April 1960 – 5 March 1961. - ✓

2026 Triple Lock: Payments are set to rise to £241.30 per week (full rate).

What’s Happening with the State Pension Age from 2026?

If you’re approaching retirement, you may be wondering how changes to the State Pension age could affect you. It’s a fair question, especially with frequent headlines about pension reforms and shifting retirement timelines. The truth is, there will be changes starting in April 2026, but they are not as sudden or as sweeping as many people believe.

Rather than everyone suddenly facing retirement at 67, the Department for Work and Pensions (DWP) has planned a gradual increase from age 66 to 67, phased in over a two-year period. This is part of long-standing legislation introduced under the Pensions Act 2014, aimed at ensuring the UK’s pension system remains financially sustainable as people live longer and healthier lives.

For most people born in the early 1960s, this means their State Pension Age (SPA) will land somewhere between 66 years and 1 month to 66 years and 11 months, depending on their exact birthdate.

Quick Summary: State Pension Age Changes 2026

- What is changing? The UK State Pension age is increasing from 66 to 67.

- When does it happen? The change is phased in between 6 April 2026 and 5 April 2028.

- Who is affected? Anyone born between 6 April 1960 and 5 March 1961 will have a retirement age between 66 and 67. Anyone born after 6 March 1961 will have a State Pension age of 67.

- How is it phased? The age increases by roughly one month for every month of birth within the transition period.

Real-World Impact: How the 2026 Change Affects You

To understand how these DWP shifts work in practice, let’s look at two common scenarios for the 2026–2028 transition period:

Case Study: Susan

Born: October 1960

The Impact: Under the old rules, Susan would retire at 66. Because she falls into the 2026 phase-in, her new State Pension age is 66 years and 7 months.

Result: Susan must wait an extra 7 months, reaching her pension in May 2027.

Case Study: James

Born: June 1961

The Impact: James was born after the March 1961 cutoff. He misses the phased “bridge” entirely.

Result: James will reach his State Pension age at exactly 67 in June 2028.

When Will the Pension Age Start to Increase and Who Will It Affect?

The increase in the State Pension age will begin in April 2026 and continue through to April 2028. This phased approach applies to both men and women, following earlier equalisation measures that aligned their pension ages.

The group most affected by this particular change are individuals born between 6 April 1960 and 5 March 1961. Rather than reaching State Pension age on a fixed date, each person within this window will reach eligibility at 66 years and a specific number of months, which increases incrementally across this two-year period.

To illustrate this more clearly, the following table shows how State Pension age increases by birth month:

State Pension Age by Birth Month (2026–2028)

| Date of Birth | New State Pension Age |

|---|---|

| 6 April 1960 – 5 May 1960 | 66 years and 1 month |

| 6 May 1960 – 5 June 1960 | 66 years and 2 months |

| 6 June 1960 – 5 July 1960 | 66 years and 3 months |

| 6 July 1960 – 5 August 1960 | 66 years and 4 months |

| 6 August 1960 – 5 September 1960 | 66 years and 5 months |

| 6 September 1960 – 5 October 1960 | 66 years and 6 months |

| 6 October 1960 – 5 November 1960 | 66 years and 7 months |

| 6 November 1960 – 5 December 1960 | 66 years and 8 months |

| 6 December 1960 – 5 January 1961 | 66 years and 9 months |

| 6 January 1961 – 5 February 1961 | 66 years and 10 months |

| 6 February 1961 – 5 March 1961 | 66 years and 11 months |

| From 6 March 1961 onwards | 67 years |

This structure replaces the older system where people reached SPA on a specific date. Instead, your retirement age is now determined more precisely by your exact date of birth, allowing for a fairer and more gradual transition.

Why Is the State Pension Age Being Increased?

The government’s decision to raise the pension age is largely driven by demographic changes. As life expectancy has increased over the decades, more people are living longer in retirement, which places a greater financial burden on the state.

In response to these trends, the Pensions Act 2014 brought forward the increase from 66 to 67 by eight years, with the phased changes beginning in 2026 instead of 2034. The idea is to balance working life with retirement so that people can enjoy retirement without jeopardising the financial stability of the public pension system.

The government reviews State Pension age every five years to ensure the system reflects changes in:

- Life expectancy

- Employment trends

- Economic forecasts

- The proportion of life people are expected to spend in retirement

These reviews can result in further adjustments to pension age schedules. However, any changes must be approved by Parliament before they take effect.

How Can Individuals Check Their Exact Pension Age?

Because the State Pension age is now calculated with such precision, it’s essential for individuals to check their specific eligibility date rather than relying on general assumptions.

The UK government offers an official State Pension age calculator on its GOV.UK website. We also recommend checking your State Pension forecast to see how much you are on track to receive. This tool allows users to input their date of birth and determine the exact date when they’ll be eligible to claim their pension.

Age UK also provides similar services and advice, especially for those nearing retirement or dealing with complex pension queries. These tools can help you plan more accurately, avoiding any surprises or income gaps during your retirement transition.

What Are the Next Planned Increases Beyond 2028?

Once the State Pension age reaches 67 in April 2028, the next increase is scheduled to raise the age further to 68, under the Pensions Act 2007. This change is currently due to take place between 2044 and 2046, affecting those born on or after 6 April 1977.

There is, however, ongoing discussion about whether this increase should be brought forward. In the 2013 Autumn Statement, the government introduced the principle that people should expect to spend no more than one-third of their adult life in retirement. Based on that calculation, future increases to age 68 or even 69 could happen sooner.

Planned Increase from Age 67 to 68 (Subject to Review)

| Date of Birth | State Pension Age | Date Reached |

| 6 April 1977 – 5 May 1977 | 68 | 6 May 2044 |

| 6 June 1977 – 5 July 1977 | 68 | 6 September 2044 |

| 6 October 1977 – 5 November 1977 | 68 | 6 May 2045 |

| 6 February 1978 – 5 March 1978 | 68 | 6 January 2046 |

| 6 April 1978 onwards | 68 | On 68th birthday |

Although these dates are law at present, the actual implementation timeline could change after future State Pension age reviews.

How Should People Prepare for the Changes in 2026 and Beyond?

With the DWP State Pension age changes approaching, it’s important that individuals take practical steps to prepare. While the increase may only be a few months for some, it can affect retirement plans, particularly if someone has already left work or intended to retire at 66.

Planning for this shift should begin early. Key actions include:

- Checking your State Pension age using official tools

- Reviewing your workplace or personal pension arrangements to identify any income gaps

- Considering options for part-time work, phased retirement, or delaying retirement if needed

- Consulting a financial advisor to create a personalised retirement plan

Even a small delay in accessing the State Pension could mean adjusting your financial strategy to bridge the gap until eligibility.

What Are Some Examples of How This Affects Individuals?

Understanding how this affects real people can help make the abstract policy clearer.

Case Example 1:

Susan, born on 14 June 1960, planned to retire at 66. Under the new schedule, she will now reach State Pension age at 66 years and 3 months, in September 2026. She will need to adjust her retirement budget to account for the three-month gap.

Case Example 2:

James, born on 1 February 1961, expected his pension at 66. However, his new retirement age is 66 years and 10 months, pushing his eligibility into December 2027. He may choose to continue working longer or use private savings during the interim.

What if You Can’t Work Until Age 67?

If the increase to 67 feels out of reach due to health or financial reasons, you may not have to wait without support. While you cannot claim your State Pension early, other DWP supports are designed to bridge this “gap”:

- Personal Independence Payment (PIP): If you have a long-term health condition or disability that makes daily tasks difficult, you can claim PIP up until you reach State Pension age. Once awarded, you can continue to receive it even after your pension starts.

- Employment and Support Allowance (ESA): If you have a health condition that limits your ability to work, “New Style” ESA can provide bi-weekly payments and, crucially, National Insurance credits to protect your future pension record.

- Support for Mortgage Interest (SMI): If you are struggling with home costs while waiting for your pension, the SMI loan can help pay the interest on your mortgage if you are receiving qualifying benefits like Universal Credit.

Why Is This Considered a Gradual Change and Not a Sudden Shift?

There has been some confusion about the 2026 changes, with many assuming the pension age will immediately rise to 67. In reality, this is a phased transition spread over two years. The monthly increments ensure that no one is caught off guard with a sudden full-year delay.

This gradual approach is designed to provide adequate time for planning and to ensure fairness, especially for those close to retirement age. It avoids abrupt shifts that could cause significant financial strain on individuals.

2026 Pension Rates: How Much Will You Receive?

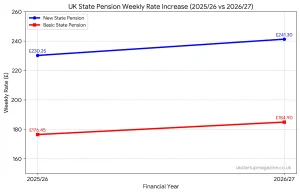

The DWP has confirmed that the Triple Lock remains in place for 2026. Because average wage growth (4.8%) was higher than inflation, the State Pension is seeing a significant boost starting in April 2026.

| Pension Type | 2025/26 Weekly Rate | New 2026/27 Weekly Rate |

| New State Pension | £230.25 | £241.30 |

| Basic State Pension | £176.45 | £184.90 |

Note on Taxes: With the full New State Pension rising to £12,548 per year, it is now only £22 below the current tax-free Personal Allowance (£12,570). If you have even a small amount of additional income (like a part-time job or private pension), you will likely pay some income tax in 2026.

Conclusion: What Should You Take Away from the State Pension Age Change in 2026?

The DWP State Pension age change in 2026 is not about sudden disruption, but a planned and structured evolution of retirement policy in the UK. For those born between April 1960 and March 1961, it means a gradual shift in retirement timing, increasing by months, not years.

As life expectancy grows and economic pressures mount, such reforms are essential to maintain a sustainable public pension system. But for individuals, the key is preparation.

By understanding the timelines, reviewing personal finances, and staying informed about government updates, people can ensure they are ready for the future, whatever it brings.

Frequently Asked Questions

Is the State Pension age rising to 67 in 2026 for everyone?

No, the increase is gradual. Between April 2026 and April 2028, the State Pension age will rise in monthly increments for those born between April 1960 and March 1961.

How do I know my exact pension date?

You can use the State Pension age calculator on GOV.UK to find out the precise date you become eligible.

Is there any way to claim the State Pension early?

In most cases, you must wait until your State Pension age. Early access is not allowed unless through private pension arrangements or certain health-related benefits.

What if I plan to retire before my State Pension age?

You’ll need to rely on private pensions, savings, or other income sources to bridge the gap until your State Pension kicks in.

Could the age rise to 68 sooner than expected?

Possibly. Government reviews could recommend bringing the increase forward, though any changes would need to pass through Parliament.

Does this change apply to men and women equally?

Yes, the State Pension age is now equalised for both genders and applies the same rules across the board.

What if I was born after April 1977?

You will be affected by the next scheduled increase to age 68, currently planned between 2044 and 2046.