Table of Contents

ToggleNavigating VAT in the property sector can be one of the most complex aspects of financial compliance in the UK. For property developers, landlords, and investors, VAT Notice 742A is a cornerstone document that outlines how the option to tax applies to land and property transactions. Getting it wrong can be costly, but understanding it thoroughly can significantly improve VAT recovery and ensure legal compliance.

What Is VAT Notice 742A?

VAT Notice 742A is a formal document published by HM Revenue & Customs (HMRC) that specifically deals with land and property transactions in the context of VAT. It provides clear guidance on when and how businesses can opt to tax their property interests and details the consequences of that decision.

What makes this notice particularly significant is that some of its content has the force of law, meaning it is legally binding under the Value Added Tax Act 1994 specifically Schedule 10. Sections A to L, along with specific paragraphs throughout the notice, are enforceable in the same way as statutory regulations.

The notice is intended for those who have a working knowledge of basic VAT principles. It assumes the reader is familiar with VAT Notice 700 (The VAT Guide) and directs users to VAT Notice 742 for general rules on land and property before diving into the complexities of the option to tax.

Why Should UK Property Businesses Care About VAT Notice 742A?

VAT Notice 742A is not just another set of guidelines it is a practical framework that shapes the tax strategy of any business involved in the development, sale, or leasing of land and property in the UK.

Property businesses are often faced with the decision to treat their supplies as exempt or taxable. The notice explains how the option to tax gives businesses control over VAT treatment, allowing them to recover input tax that would otherwise be lost on exempt supplies.

For example, a developer constructing a new commercial office block can opt to tax the property, meaning they can reclaim VAT on building materials, professional fees, and other related costs. Without this option, the supply would be exempt, and VAT recovery would be blocked, leading to a substantial cost burden.

It also addresses situations where the option to tax does not apply, such as residential lettings, charitable buildings, and caravan pitches. Understanding these exclusions is equally critical to avoid overcharging VAT or facing penalties for incorrect treatment.

How Does VAT Apply to Land and Property in the UK?

The VAT system treats most land and property transactions as exempt. This means no VAT is charged on the supply, and the supplier cannot recover the VAT incurred on associated costs.

However, the option to tax allows a business to elect for certain exempt property transactions, particularly involving commercial properties, to become taxable at the standard VAT rate. This is particularly beneficial when the business wants to recover VAT on building costs, maintenance, or renovations.

It’s important to note that “land” in VAT terms includes any buildings or structures permanently affixed to the ground. One does not need to own the property to opt to tax; having an interest in it (e.g., through a lease or license) is sufficient.

Understanding the financial impact of the option to tax is essential. You can quickly estimate how VAT will affect your transactions with our VAT Calculator.

What Are the Key Rules and Provisions in VAT Notice 742A?

VAT Notice 742A provides detailed instructions on the mechanics of opting to tax, including:

- Who may opt to tax

- When HMRC permission is required

- The timing and process of notification

- How to handle changes to the property

The notice is underpinned by UK VAT legislation, specifically:

- Group 1 of Schedule 9 to the VAT Act 1994 defines exempt land and property supplies

- Schedule 10 of the same Act governs the procedures and legal validity of opting to tax

The notice also includes binding content marked as having the force of law, which businesses must follow precisely. This includes requirements around notification forms, certification processes, and timing of submissions.

What Does ‘Opting to Tax’ Mean and Who Should Consider It?

The “option to tax” refers to a decision made by a business to treat supplies of land or property as taxable rather than exempt. This decision allows businesses to reclaim input VAT on costs associated with that property.

The option applies only to commercial property and does not affect residential supplies unless they’re mixed-use or repurposed.

There are two parts to the process:

- Making the decision: This should be formally documented, for instance in meeting minutes or signed agreements. It should clearly describe the property and the effective date of the option.

- Notifying HMRC: This is usually done via Form VAT1614A, submitted within 30 days of the decision.

If you’ve previously made exempt supplies of the property, HMRC permission may be required before opting. Permission is also needed in certain complex scenarios, such as where anti-avoidance rules apply.

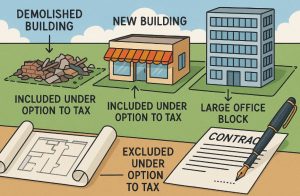

What Is Covered by the Option to Tax?

The scope of an option to tax depends on what is specified in the notification. Businesses may opt:

- A building, in which case the option extends to the land beneath it and any adjacent land within its curtilage (immediate surroundings such as yards or forecourts)

- A parcel of land, in which case the option applies to current and future buildings on it unless excluded

The law also clarifies that the option survives demolition. If a building is demolished, the option continues to apply to the land and any new structure built on it. The only exception is for pre-2008 options, where the intention was limited to a specific structure, and evidence supports that limitation.

If a building is extended or linked to another structure, the option typically flows through. However, if buildings are linked after completion, the option doesn’t automatically transfer.

Businesses can exclude a newly constructed building from the scope of a previous option, provided they follow HMRC’s process using Form VAT1614F, and do so after construction has begun.

What Are Common Scenarios Where VAT Notice 742A Applies?

VAT Notice 742A affects a range of everyday scenarios in the property industry. Some examples include:

- Leasing an office in an opted building where VAT must be charged on rent

- Selling a newly built warehouse where VAT is applicable unless the sale qualifies as a Transfer of a Going Concern (TOGC)

- Developing a mixed-use property, such as a retail unit with flats above, requires careful apportionment of VAT between taxable and exempt parts

- Constructing a commercial building on opted land, with potential input VAT recovery

Each scenario demands a careful reading of the rules to avoid applying VAT where it’s not due, or missing the chance to recover tax where it is.

When Is the Option to Tax Not Applicable?

There are specific transactions where the option to tax is disapplied, even if you’ve previously opted the land or building. These include:

- Supplies of residential dwellings, such as houses or flats, which are designed or adapted for residential use

- Buildings used for relevant residential purposes, such as care homes, student accommodation, or hostels

- Supplies for relevant charitable purposes, where the buyer intends to use the building exclusively for non-business or community purposes

- Land or property sold to housing associations or individuals intending to build private homes

- Caravan pitches and moorings for residential houseboats

In many of these cases, the exemption applies only if specific certificates (such as VAT1614D or VAT1614G) are received before the contract price is legally fixed. The timing and format of these certificates are covered in legally binding sections of the notice.

When Should a Property Business Register for VAT in the UK?

Property businesses must register for VAT if their taxable turnover exceeds the current threshold, which for the 2024/25 tax year is £90,000. This includes rental income from opted properties and sales of taxable commercial property.

Even if below the threshold, a business might register voluntarily to:

- Reclaim input VAT

- Prepare for future taxable transactions

- Improve business credibility and documentation standards

Upon registration, businesses must submit regular VAT returns, keep detailed records, and apply the correct treatment to each transaction.

What Are the Common Pitfalls to Avoid with VAT Notice 742A?

Many errors occur because businesses fail to understand the nuances of the rules. Common mistakes include:

- Failing to notify HMRC of the option within the required 30-day period

- Applying the option to tax to residential property in error

- Misinterpreting the coverage of the option, especially with demolished or reconstructed buildings

- Accepting certificates after prices are legally fixed, invalidating the exemption

- Assuming the option transfers to a buyer, it doesn’t. The buyer must make their own election

Avoiding these mistakes requires regular training, updated procedures, and professional advice where necessary.

What Is the Capital Goods Scheme and How Does It Affect Property VAT?

The Capital Goods Scheme (CGS) is a method for adjusting the amount of input VAT claimed on high-value capital items (including property) over several years. If the use of a property changes, such as from taxable to exempt use, adjustments must be made to reflect the new use.

For land and property, CGS typically applies for 10 years after the original VAT claim. Businesses must track:

- The VAT originally claimed

- The use of the property each year

- Any changes that impact eligibility

Failing to adjust VAT under the CGS could lead to penalties or overpayments.

How Can UK Property Businesses Stay Compliant with VAT Notice 742A?

To ensure compliance, property businesses should:

- Keep formal records of decisions to opt to tax

- Submit all required notifications using correct HMRC forms (VAT1614A, VAT1614F, etc.)

- Understand the exclusions and properly manage certification

- Monitor changes in property use and apply CGS if applicable

- Seek professional VAT advice for complex transactions or redevelopment projects

Compliance not only avoids penalties but also enhances financial efficiency.

Why Is Understanding VAT Notice 742A Crucial for Long-Term Property Success?

VAT Notice 742A is essential for ensuring UK property businesses apply VAT correctly. From the construction of new commercial spaces to the leasing of mixed-use properties, the implications of this notice touch every aspect of the industry. By mastering its principles, businesses can:

- Maximise VAT recovery

- Avoid costly errors

- Structure transactions strategically

- Maintain compliance with UK VAT law

Understanding and applying VAT Notice 742A is a strategic asset not just a compliance requirement.

VAT Notice 742A Rules

| Area | Summary |

| Applicable Law | VAT Act 1994 – Schedule 9 & 10 |

| Legal Status | Contains force of law in various paragraphs and sections |

| Primary Forms | VAT1614A, VAT1614D, VAT1614F, VAT1614G |

| Covered Transactions | Sale, lease, construction, redevelopment of land/buildings |

| Disapplied Scenarios | Dwellings, charities, houseboats, caravan pitches |

| Notification Window | 30 days (standard) with discretion for late cases |

| VAT Threshold (2024/25) | £90,000 taxable turnover |

When HMRC Permission Is Required to Opt to Tax?

Before a business can legally exercise the option to tax a property, certain preconditions must be met. One of the most critical is determining whether HMRC’s prior permission is required.

HMRC mandates that written permission must be obtained if a business has made, or intends to make, exempt supplies relating to the land or buildings in question during the ten years prior to the proposed effective date of the option.

This requirement exists to prevent misuse of the option mechanism and to ensure fair VAT treatment across transactions.

However, HMRC recognises that in many commercial scenarios, such permission would be unnecessarily burdensome. Therefore, they have set out a framework of automatic permission conditions under which prior written consent is not needed.

What Is Automatic Permission and When Does It Apply?

Automatic permission to opt to tax means a business can proceed with the election without seeking formal approval from HMRC. This is only possible if at least one of four specific conditions, defined in law, is satisfied.

Automatic Permission Conditions (With Legal Standing)

Mixed-Use Developments (Condition 1)

If the land or property has only been used for residential purposes in a mixed-use development and all exempt supplies relate solely to the dwellings, automatic permission is granted.

No Input VAT Recovery and Limited Past Supplies (Condition 2)

This applies where a business has:

- No intention of recovering VAT incurred before the option takes effect

- Only received income from regular rents or service charges (excluding premiums or irregular payments)

- Intends to recover input VAT in the future solely on routine overheads (e.g., maintenance, service charges)

In this case, the business may proceed without written permission, provided it has not engaged in activities like refurbishment or redevelopment, which would invalidate this condition.

Outputs and Inputs Test (Condition 3)

This condition involves a dual test:

- Outputs Requirement: The business must not expect that any taxable supply created by the option will:

- Be made to a connected person, unless they can recover 80% or more of the VAT

- Follow an exempt right of occupation continuing post-option date

- Inputs Requirement: The business must not expect to use the property for:

- Making exempt supplies that block input VAT recovery

- Private or non-business purposes

Certain exceptions apply, such as exempt supplies under specific VAT schedules or where the total input tax involved is less than £5,000.

Incidental Use of Property (Condition 4)

If all exempt supplies made in the past were incidental to the main taxable use, automatic permission may be granted.

Incidental uses could include leasing space for radio masts, displaying advertising, or allowing an electricity substation. Letting the property to a tenant, however minimal, does not qualify as incidental use.

How to Notify HMRC if Automatic Permission Applies?

Even if you qualify for automatic permission, you are still legally required to notify HMRC of your intention to opt for tax. This should be done using form VAT1614A, and your notification must:

- Confirm that exempt supplies have previously occurred

- Clearly state which automatic condition is being relied upon

Proper documentation and a clear audit trail are essential to demonstrate compliance, especially if HMRC later reviews the validity of your option.

Applying for Permission When Conditions Are Not Met

Where none of the automatic conditions apply, you must apply to HMRC for permission using form VAT1614H. This application must be complete and provide all requested information.

Once permission is granted:

- The option to tax takes effect either from the date of application or a later date specified by you

- There is no separate notification requirement; permission serves as both approval and notification

If permission is denied, it is usually because HMRC concludes that allowing the option would result in an unfair allocation of VAT, for example, where input tax would be reclaimed but future use would be VAT-exempt.

Consequences of Failing to Obtain Required Permission

If a business proceeds with an option to tax without obtaining HMRC’s permission (when required), the option is technically invalid. However, HMRC may choose to treat the option as valid under specific conditions. This discretion is generally exercised where:

- The omission was an honest mistake, such as failing to account for a one-off exempt supply

- There is a risk to tax revenue if the option is not allowed

In such cases, you must contact HMRC with full details, and a decision will be made based on the specifics of your situation.

VAT Registration and the Option to Tax

Interaction Between the Option to Tax and VAT Registration

Opting to tax a property often necessitates VAT registration. If your business is not already registered for VAT and you intend to make taxable supplies through the option, you must apply for VAT registration at the same time.

You should include:

- The completed VAT registration application

- The option to tax notification (or permission, if applicable)

If permission to opt is pending, registration will also be delayed. The registration unit must be satisfied that the business is making, or intends to make, taxable supplies before approving the application.

If the business later de-registers for VAT, the option to tax still remains in force.

Record Retention for Opting to Tax

HMRC requires that all documentation related to the option to tax, such as internal decisions, notifications, permissions, and correspondence, be retained for at least six years. However, given that an option cannot usually be revoked for 20 years, longer retention is highly advisable.

Keeping accurate and accessible records ensures that:

- The business can prove the validity of the option

- Any future disputes with HMRC are easier to resolve

How Group VAT Registration Affects the Option to Tax?

Relevant Associates Within VAT Groups

If a business is part of a VAT group, the option to tax may affect other group members. A business that becomes bound by another group member’s option is known as a “relevant associate.”

This designation means that even after leaving the group, the associate remains responsible for charging VAT on supplies of the opted property.

You become a relevant associate if:

- You are in the group when the original member opted to tax

- You later acquire an interest in the opted property while in the same group

- You succeed another relevant associate with an interest in the property

Ending Your Status as a Relevant Associate

There are three pathways for ceasing to be a relevant associate:

1. Automatic Cessation

You will automatically cease to be a relevant associate if you:

- Are no longer in the original VAT group

- No longer holds an interest in the opted property

- Have no deferred obligations tied to that property (e.g., overage clauses)

- Are not connected to any current holder or operator

No notification is required—status ceases automatically once all conditions are met.

2. Section E Compliance and Notification

If you cannot automatically cease, but you satisfy the criteria under Section E of Schedule 10 (which includes holding the interest for 20 years, no undervalued sales, no capital goods scheme liabilities), you must notify HMRC using form VAT1614B.

This section has the force of law and is legally binding.

3. HMRC Permission

If you do not qualify under Section E, you may apply for HMRC’s permission to cease being a relevant associate. Your application must:

- Be made on form VAT1614B

- Include all required information

HMRC will assess whether VAT benefits were obtained through group arrangements and whether all preconditions have been met. If granted, cessation takes effect from the date of approval.

In cases of genuine error, HMRC may backdate cessation if they are satisfied the oversight was minor and no VAT benefit was gained.

Key Forms Required for VAT Notice 742A Compliance

| Form | Purpose |

| VAT1614A | Notify HMRC of a decision to opt to tax land or buildings |

| VAT1614F | Notify the exclusion of a new building from an option |

| VAT1614D | Certify intended residential use (e.g., flats, nursing homes) |

| VAT1614G | Housing association certificate for intended residential construction |

| VAT1614H | Apply for HMRC permission to opt to tax when automatic conditions fail |

| VAT1614B | Notify or apply to cease being a relevant associate in a VAT group |

FAQs About VAT Notice 742A

Does VAT Notice 742A contain legally enforceable rules?

Yes. Specific sections and paragraphs carry the force of law, especially under Schedule 10 of the VAT Act 1994.

Can a business opt to tax land they lease but don’t own?

Yes. Holding an interest in the property, such as a lease, qualifies you to opt to tax.

Do I always need HMRC permission to opt to tax?

Not always. Permission is only required under specific conditions, such as when exempt supplies have previously been made.

Can I revoke an option to tax?

Yes, within six months using the “cooling-off” period or after 20 years, with formal revocation.

What form do I use to notify an option to tax?

Use Form VAT1614A. For exclusions or residential use, other forms such as VAT1614F and VAT1614D apply.

Does an option to tax automatically apply to future buildings?

Yes, unless a new building is specifically excluded using the proper procedure.

How do I handle mixed-use buildings?

You must apportion the supply fairly between taxable and exempt areas based on usage and certification.