Table of Contents

ToggleIf you are a carer on Universal Credit and you provide care for at least 35 hours a week for a severely disabled person, you do not usually have to look for work. Once your caring role is reported and accepted, Universal Credit places you in the no work related requirements group, meaning there is no obligation to job search or be available for work.

Key takeaways

- Caring for 35 hours or more each week removes job search requirements

- The person cared for must receive a qualifying disability benefit

- You do not need Carer’s Allowance to be exempt from work requirements

- Reporting your caring role in your Universal Credit journal is essential

This guidance is based on official government rules and trusted welfare advice sources, ensuring accurate and up to date information.

What Are the Work Requirements on Universal Credit?

Universal Credit is designed to support people on a low income while encouraging those who can work to prepare for employment. When someone makes a claim, they are required to accept a claimant commitment. This commitment explains what the claimant must do in return for receiving Universal Credit and it is tailored to personal circumstances such as health, family responsibilities, and caring roles.

For people who are fit and available for work, the claimant commitment usually involves looking for work, applying for jobs, attending Jobcentre appointments, and spending a set number of hours each week on work related activities. These requirements can feel demanding, as job seeking is treated as a full time responsibility.

However, Universal Credit rules recognise that not everyone is in a position to work. The system includes different work related groups, ranging from full work search to no work related requirements at all.

If circumstances change, such as becoming a carer or developing a health condition, the claimant commitment must be updated. Failing to meet the agreed commitments without a valid reason can lead to a reduction in payments, known as a sanction, which is why accurate reporting of personal circumstances is so important.

Who Is Exempt from Looking for Work on Universal Credit?

Universal Credit provides exemptions from work search requirements for people whose circumstances make employment unrealistic or inappropriate. One of the most important exempt groups includes unpaid carers who provide significant levels of care.

People may be exempt from looking for work if they fall into certain categories recognised by the Department for Work and Pensions. These exemptions exist to prevent unnecessary pressure and to reflect real life responsibilities.

Common exemptions include:

- Carers providing at least 35 hours of care each week for someone with a qualifying disability benefit

- People assessed as having limited capability for work and work related activity

- Individuals with a terminal illness

- Parents caring for a child under the age of one

- People performing certain public duties such as jury service

For carers, the exemption is clear once the caring role is properly declared. When accepted, the carer is placed in the no work related requirements group.

This means no job search, no mandatory training, and often no work coach appointments. The exemption applies even if the carer lives with a partner or works part time, provided the caring criteria are met.

What Qualifies You as a Carer on Universal Credit?

To be recognised as a carer under Universal Credit rules, specific conditions must be met. The most important requirement is the amount of care provided.

You must be caring for someone for at least 35 hours per week. This care is usually unpaid and can include personal care, emotional support, help with daily tasks, or managing medical needs.

The person being cared for must also receive a qualifying disability related benefit. Universal Credit recognises caring roles only when the cared for person is officially assessed as needing support.

Qualifying benefits include:

- Personal Independence Payment daily living component

- Disability Living Allowance at the middle or higher care rate

- Attendance Allowance

- Armed Forces Independence Payment

It is also essential that the caring role is reported to Universal Credit. Simply providing care is not enough if the Department for Work and Pensions is not informed.

Once declared, the caring role is reflected in the claimant commitment. If these conditions are met, the claimant is treated as a full time carer and is not expected to look for work or prepare for employment.

Do You Need to Receive Carer’s Allowance to Be Exempt?

Many people assume that receiving Carer’s Allowance is required to be exempt from work search requirements on Universal Credit. This is not correct. Universal Credit and Carer’s Allowance are separate benefits with different rules, although they interact financially.

At the start, it is important to understand that Universal Credit focuses on your caring responsibilities, not whether you receive another benefit. As long as you care for someone for 35 hours or more each week and they receive a qualifying disability benefit, you can be placed in the no work related requirements group.

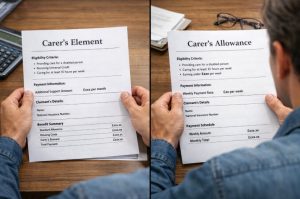

Difference between Carer’s Allowance and Carer Element in UC

Carer’s Allowance is a separate weekly benefit paid to people who meet specific caring and earnings rules. Universal Credit includes a Carer Element, which is an additional amount added to your monthly Universal Credit payment. The Carer Element recognises your caring role within Universal Credit itself.

You Can Receive the Carer Element Without Getting Carer’s Allowance

It is possible to receive the Carer Element even if you do not claim Carer’s Allowance. Some carers do not qualify for Carer’s Allowance due to earnings or overlapping benefits, yet they still qualify for the Carer Element. This is often enough to remove work search requirements, as the exemption is linked to the caring role, not the allowance.

Explanation of Income Deduction for Carer’s Allowance

If you do receive Carer’s Allowance while claiming Universal Credit, the allowance is treated as unearned income. This means it is deducted pound for pound from your Universal Credit payment. However, the Carer Element is still added, which often leaves carers slightly better off overall. Despite the deduction, the work search exemption remains fully in place.

What Happens If You Don’t Report Your Caring Responsibilities?

Failing to report your caring responsibilities can lead to unnecessary stress and incorrect work expectations. Universal Credit does not automatically know you are a carer unless you inform them through your online account or journal.

If your caring role is not declared, you may be placed in a work search group by default.

This could result in:

- Being asked to apply for jobs

- Mandatory attendance at Jobcentre appointments

- Risk of sanctions if requirements are not met

Many carers experience confusion during the early stages of a claim, especially if they are waiting for confirmation of the cared for person’s benefit. During this period, work coaches may still apply job search conditions.

This is why it is strongly recommended to update your journal as soon as caring begins, even if paperwork is still being processed.

Once the caring role is verified, the claimant commitment should be updated and work search requirements removed. Prompt reporting protects carers from inappropriate expectations and potential payment reductions.

Can You Work Part Time and Still Be Considered a Carer?

Yes, you can work part time and still be recognised as a carer on Universal Credit. Caring is treated as a significant responsibility, and the system does not require carers to increase their working hours beyond what is manageable.

If you meet the caring threshold of 35 hours per week, you are not expected to look for additional work or increase your hours, even if you are employed. This applies whether you are working a few hours a week or earning below typical thresholds.

Universal Credit recognises that caring is effectively a form of work, even though it is unpaid. As long as your caring responsibilities remain in place and are reported, you remain in the no work related requirements group.

Any changes to work hours or caring arrangements should still be reported, but part time employment alone does not remove your exemption. This flexibility helps carers maintain some income without risking inappropriate work demands.

What If the Person You Care For Loses Their Benefit?

If the person you care for stops receiving a qualifying disability benefit, your status as a carer under Universal Credit rules may change. This could happen due to a reassessment, an appeal outcome, or a change in circumstances.

When the qualifying benefit ends, Universal Credit may no longer recognise the caring role for exemption purposes. This does not happen automatically, but it becomes a possibility once the Department for Work and Pensions is notified.

It is essential to report this change immediately through your Universal Credit account. Your claimant commitment may then be reviewed and updated. Depending on your circumstances, you could be moved into a different work related group, such as work preparation or work search.

However, work coaches are expected to consider individual situations carefully. Transitional periods, health impacts, or other responsibilities may still reduce work expectations. Prompt communication ensures decisions are fair and avoids misunderstandings or sanctions during a difficult transition.

How to Officially Inform Universal Credit You Are a Carer?

Reporting your caring role correctly is the key step in removing work search requirements. Universal Credit relies heavily on self reporting through the online system.

To officially inform Universal Credit, you should:

- Log in to your Universal Credit online account

- Use the journal to report a change of circumstances

- Clearly state that you provide at least 35 hours of care per week

- Confirm the benefit received by the person you care for

You may also be contacted by a work coach to clarify details. In most cases, no formal proof is required immediately, but accurate information is essential. Once accepted, your claimant commitment should be updated to reflect no work related requirements.

It is also helpful to keep your journal updated if anything changes. This ensures your Universal Credit claim remains accurate and protects your entitlement. Clear communication through the journal is the most effective way to secure the correct exemption.

Carer’s Element vs Carer’s Allowance: What’s the Difference?

Although they sound similar, Carer’s Allowance and the Carer Element of Universal Credit serve different purposes. Understanding the distinction helps carers make informed decisions.

Carer’s Allowance is a weekly benefit paid to carers who meet strict earnings and study rules. It exists outside Universal Credit and is claimed separately. The Carer Element is part of Universal Credit and increases the monthly award to reflect caring responsibilities.

Key differences include:

- Carer’s Allowance is paid weekly while the Carer Element is paid monthly

- Carer’s Allowance affects Universal Credit as unearned income

- The Carer Element does not depend on receiving Carer’s Allowance

Many carers claim Universal Credit instead of relying solely on Carer’s Allowance, as the allowance alone is often not enough to live on. While claiming both leads to deductions, the overall support and exemption from work requirements often make Universal Credit the more sustainable option for carers.

Summary of Carer Rules on Universal Credit

Understanding how different situations affect work requirements can help carers feel more confident about their Universal Credit claim. The table below summarises key scenarios.

| Situation | Work Search Required | Key Notes |

| Caring 35 hours or more with qualifying benefit | No | Must be reported in UC journal |

| Caring less than 35 hours | Possibly | Commitment may be adjusted |

| Receiving Carer’s Allowance | No | Allowance deducted from UC |

| Working part time while caring | No | No requirement to increase hours |

| Caring role not yet reported | Yes | Update journal immediately |

This summary highlights the importance of accurate reporting and ongoing communication. Universal Credit decisions are based on current information, and carers who stay proactive are more likely to receive the correct support. Understanding these rules reduces anxiety and helps carers focus on their essential role.

Conclusion

For carers claiming Universal Credit, the rules are clear once they are properly understood. If you provide at least 35 hours of care each week for someone receiving a qualifying disability benefit, you generally do not have to look for work. This exemption exists to recognise the value and intensity of unpaid caring.

The most important step is reporting your caring role promptly and accurately through your Universal Credit account. Doing so places you in the correct group and removes inappropriate work demands.

While benefits such as Carer’s Allowance and the Carer Element can seem complex, they are designed to work alongside Universal Credit rather than restrict it.

By staying informed and keeping your claim up to date, you can focus on caring responsibilities without the added pressure of job search requirements.

FAQs

Do I have to attend Jobcentre appointments if I am a carer on Universal Credit?

If you are placed in the no work related requirements group, you are usually not required to attend regular Jobcentre appointments. Any contact is normally limited to claim reviews or changes in circumstances.

Can Universal Credit ask me to look for work while my caring role is being assessed?

Yes, this can happen if your caring role has not yet been confirmed. Updating your journal early helps reduce this risk.

Do I Have to Look for Work if I Am a Carer on Universal Credit

Caring is not paid employment, but Universal Credit recognises it as a full time responsibility. This recognition removes job search requirements.

What if I care for more than one person?

You only need to meet the 35 hour caring requirement for one qualifying person. Additional caring does not change the exemption status.

Can my partner also be exempt if we both care?

Yes, if both partners independently meet the caring conditions, each can be exempt from work requirements.

Will savings affect my carer exemption?

Savings do not affect whether you must look for work. However, they may affect overall Universal Credit entitlement.

Should I use a benefits calculator before claiming?

Using a benefits calculator can help estimate payments and clarify how caring affects your claim. It does not replace reporting your role to Universal Credit.