Table of Contents

ToggleWhat Does the Rachel Reeves Car Tax Hike Mean for the UK?

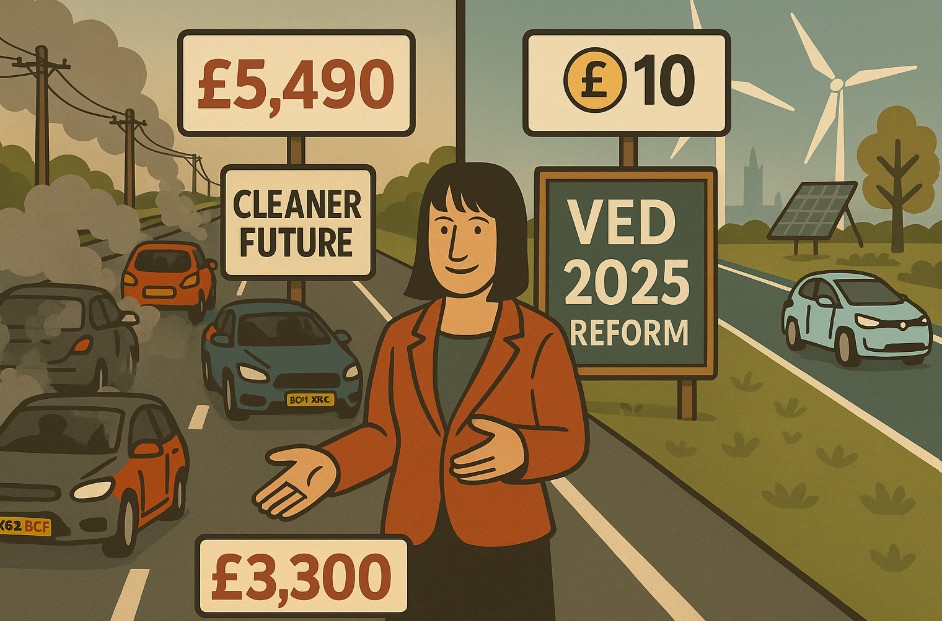

On 1 April 2025, a sweeping transformation to the UK’s vehicle taxation system came into effect, marking a decisive policy shift under Chancellor Rachel Reeves. At the centre of this reform is the Vehicle Excise Duty (VED) overhaul what many are referring to as the Rachel Reeves car tax hike.

These changes affect all drivers in the UK, particularly those purchasing new petrol or diesel vehicles. The first-year tax for the most polluting cars now reaches a staggering £5,490, compared to previous rates which were significantly lower.

While aimed at encouraging low-emission vehicle adoption and advancing Labour’s green transport agenda, the scale and suddenness of the change have sparked strong reactions from motorists, trade bodies, and environmental groups alike.

This policy rollout signals that vehicle taxation in the UK is no longer just a fiscal mechanism it’s now a core component of the Government’s climate strategy.

What Are the Key Details of Rachel Reeves’ Proposed Car Tax Policy?

The new car tax policy builds on earlier reforms introduced by the Conservative government under Jeremy Hunt, but Labour’s plan implements them more broadly and at a faster pace. Rachel Reeves announced during the Autumn Statement that, from April 2025, VED rates would rise sharply across multiple emissions bands.

First-Year VED Changes (Effective 1 April 2025)

| CO₂ Emissions (g/km) | 2024 Rate | 2025 Rate | Increase |

| 0 (Electric Vehicles) | £0 | £10 | +£10 |

| 1–50 | £10 | £110 | +£100 |

| 51–75 | £30 | £130 | +£100 |

| 76–90 | £135 | £270 | +£135 |

| 91–100 | £175 | £350 | +£175 |

| 101–110 | £195 | £390 | +£195 |

| 111–130 | £220 | £440 | +£220 |

| 131–150 | £270 | £540 | +£270 |

| 151–170 | £680 | £1,360 | +£680 |

| 171–190 | £1,095 | £2,190 | +£1,095 |

| 191–225 | £1,650 | £3,300 | +£1,650 |

| 226–255 | £2,340 | £4,680 | +£2,340 |

| Over 255 | £2,745 | £5,490 | +£2,745 |

These figures represent the most aggressive first-year VED increases ever implemented in the UK. The aim, according to Reeves, is to ensure that those purchasing polluting vehicles bear a proportionate share of the environmental cost.

Electric vehicles, once entirely exempt from road tax, are now required to pay a modest £10 annually. This fee is frozen until 2029–30 to maintain affordability while signalling that free EV ownership is coming to an end.

Why Is Labour Planning to Increase Vehicle Tax in 2025?

The reasoning behind the tax hike rests on two main policy priorities:

Environmental Objectives

As part of Labour’s commitment to achieving Net Zero by 2050, these changes are designed to influence consumer behaviour. High first-year taxes on petrol and diesel vehicles aim to make electric vehicles more economically attractive, even before factoring in running costs.

By “widening the differentials” between emission classes, Reeves intends to accelerate the retirement of high-pollution vehicles from UK roads.

Economic Strategy

The UK Treasury faces enduring financial pressure following a period of economic turbulence post-pandemic. Vehicle Excise Duty has long been a source of revenue, but flat or low rates have limited its growth.

Reeves’ approach indexes VED rates to the Retail Price Index (RPI), ensuring that taxation rises in line with inflation and delivers consistent funding for infrastructure, the NHS, and environmental programmes.

How Will Different Types of Drivers Be Affected by the Tax Hike?

Not all motorists will experience the car tax hike in the same way. The effect depends heavily on vehicle emissions, purchase timing, and fuel type.

Impact by Vehicle Category

| Vehicle Type | Expected Impact |

| Petrol & Diesel (High Emission) | First-year VED up to £5,490 |

| Plug-In Hybrid Vehicles | First-year VED starts at £110 |

| Electric Vehicles (EVs) | Annual charge of £10, frozen until 2029 |

| Older Diesel Cars (Used Market) | Higher annual VED due to poor emissions |

| Luxury/Performance Vehicles | Facing full impact of top-tier VED rates |

The cost for buyers of traditional internal combustion engine (ICE) vehicles has increased substantially, particularly those buying new, large-engine or high-performance cars. Meanwhile, EVs remain far more affordable in the long term, not only due to tax but also lower fuel and maintenance costs.

DVLA Enforcement & Fines

The Driver and Vehicle Licensing Agency (DVLA) has stepped up compliance activity. Failure to pay VED now carries stiffer penalties:

- £80 fine for registered owners of untaxed vehicles

- £1,000 fine or five times the tax owed for driving an untaxed vehicle without declaring it SORN (Statutory Off Road Notification)

What Will Be the Economic Impact of the Car Tax Rise in the UK?

The economic implications of the Rachel Reeves car tax hike extend far beyond individual drivers. These tax reforms will influence car manufacturers, retailers, insurers, logistics providers, and local authorities.

Predicted Sectoral Impact

| Sector | Predicted Outcome |

| Automotive Retail | Drop in high-emission vehicle sales |

| Used Car Market | Surge in demand for low-emission used vehicles |

| Insurance Providers | Adjusted premiums based on fleet composition |

| Fleet & Delivery Firms | Increased operating costs for diesel vans |

| EV Manufacturers | Competitive advantage via tax-efficient models |

Additionally, motor industry analysts predict a temporary stagnation in new car purchases as buyers wait for further policy clarity or potential grants and subsidies.

How Does Labour’s Car Tax Proposal Compare to Previous Government Policies?

The Conservative-led government under Jeremy Hunt proposed initial steps toward EV taxation but adopted a slower rollout. Labour’s approach is more ambitious and reflects ideological divergence between the parties on climate and fiscal policy.

Comparison of Key Policy Areas

| Area | Conservative Approach | Labour Approach |

| EV VED | Proposed in 2022 for 2025 | Implemented in 2025 (£10/year) |

| VED First-Year Charges | Minor annual increases | Up to 100% increases |

| CO₂ Emission Banding Emphasis | Present, but limited | Central to policy |

| Fuel Duty Reform | Not addressed | Under review (possible future rise) |

| Polluter Pays Principle | Weakly applied | Strongly embedded |

Labour’s structure sends a clear market signal polluting vehicles are no longer just less sustainable; they are more expensive from the outset.

What Do the Public and Automotive Industry Think About the Tax Hike?

The policy rollout has generated mixed responses.

Public Sentiment

Online forums, news platforms, and social media channels reflect a divided reaction:

- Many motorists see the tax as punitive, particularly in rural areas where public transport is limited.

- Others acknowledge the necessity of strong measures to curb emissions and support environmental priorities.

A GB News article reported over 200 comments within hours, with sentiments split between support for clean air policies and concerns about affordability.

Industry Position

Trade groups such as the Society of Motor Manufacturers and Traders (SMMT) have warned that rapid changes may disrupt market demand. They support a structured transition, particularly for businesses managing fleets and SMEs without the capital to switch immediately to EVs.

Conversely, environmental organisations like Green Alliance have endorsed the move as a bold step toward sustainable mobility.

How Can UK Drivers Prepare for the Potential Tax Increase?

Adapting to this tax environment will require proactive planning, especially for those considering a vehicle purchase in 2025 or beyond.

Recommendations for Motorists

- Review a vehicle’s CO₂ emissions before purchase

- Use the HMRC and DVLA calculators to forecast first-year VED

- Consider EVs or ultra-low emission vehicles, especially for long-term ownership

- Ensure on-time tax payment to avoid fines

- Evaluate total cost of ownership, not just vehicle price

While hybrid vehicles still enjoy certain advantages, it’s clear that the UK tax system now overwhelmingly favours full electric.

Is the Rachel Reeves Car Tax Hike a Step Toward Reform or a Financial Burden?

The answer is complex. For the Government, the tax hike is a tool for environmental correction and fiscal expansion. For the average motorist, it’s a new economic consideration at a time of ongoing cost-of-living concerns.

The policy encourages long-term savings via cleaner vehicles but may penalise those unable to afford new or electric models. The challenge ahead lies in bridging the affordability gap, perhaps through grants or zero-interest loans for EVs.

Ultimately, this is not just a tax change it is a shift in how Britain thinks about car ownership, responsibility, and environmental impact.

Frequently Asked Questions

What cars will be most affected by the Rachel Reeves car tax hike?

High-emission petrol and diesel vehicles, particularly those emitting over 255g/km of CO₂, face the steepest increases with first-year tax up to £5,490.

When did the new car tax rates come into effect?

The updated Vehicle Excise Duty rates were implemented on 1 April 2025.

Will electric vehicles remain tax-exempt?

No. EVs are now subject to a £10 annual VED, although this rate is frozen until 2029–30.

What happens if I fail to pay my car tax on time?

Registered keepers may receive an £80 fine, and using an untaxed vehicle on public roads without a SORN declaration can lead to a £1,000 fine.

Are these tax changes permanent?

They are expected to remain in place indefinitely, with annual adjustments tied to RPI inflation.

What vehicles are best suited for avoiding high tax?

Electric and plug-in hybrid vehicles with emissions under 50g/km of CO₂ will incur significantly lower VED charges.

Is this part of Labour’s Net Zero strategy?

Yes. The tax hike is integral to the party’s broader green transport policy aimed at decarbonising UK roads by 2050.