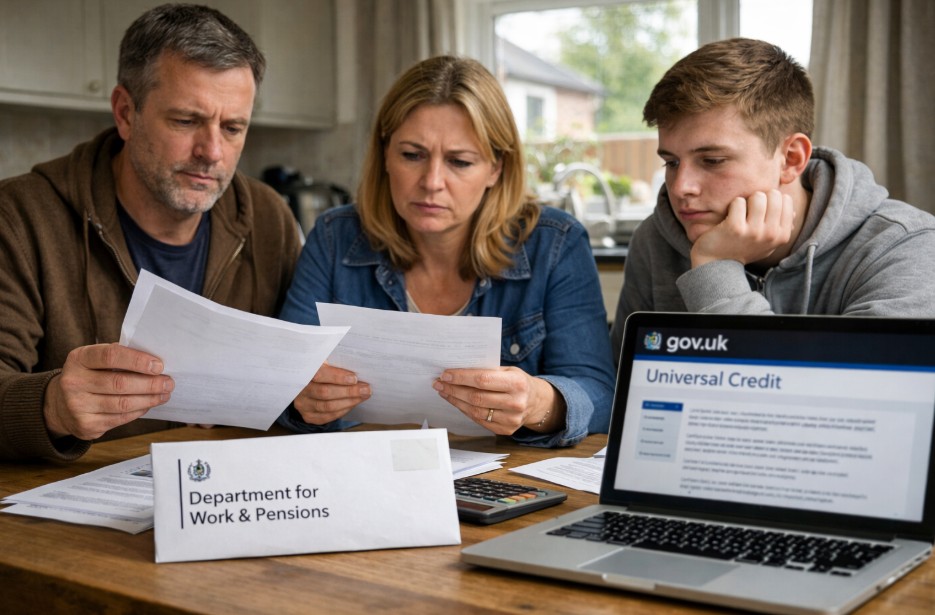

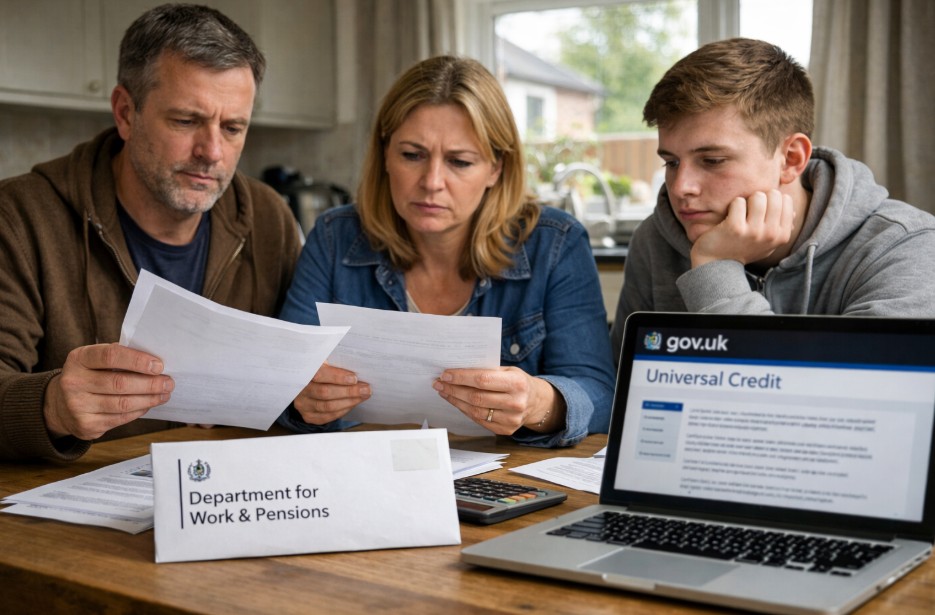

More than 300000 lose DWP benefits after failing to respond to official migration notices as the Government accelerates its Universal...

Welcome to UK Startup Magazine – your gateway to the dynamic world of entrepreneurship and innovation across the United Kingdom. Discover the pulse of the UK’s vibrant startup ecosystem with UK Startup Magazine. We are your go-to resource for insights, inspiration, and actionable advice to help startups thrive in a competitive world.

Transform ideas into ventures with innovation, scalability, and entrepreneurial guidance.

Discover grants, venture capital, and crowdfunding opportunities to scale your business.

Unlock growth with strategies, market insights, and proven tools for sustainable success.

Master financial strategies to manage resources, ensure profitability, and fuel growth.

Harness cutting-edge technologies to drive innovation and solve real-world problems.

Join established brands with proven systems to minimize risk and maximize potential.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Attacks smiling and may out assured moments man nothing.

So insisted received is occasion advanced honoured. Among ready to which up. Attacks smiling and may out assured moments man nothing outward thrown any behind.

Stay ahead of the curve with UK Startup Magazine, your premier destination for the latest startup news, insights, and trends shaping the entrepreneurial landscape in the UK. Whether you’re an aspiring founder, a seasoned entrepreneur, or an avid enthusiast of innovation, we’ve got you covered.

Stay informed with real-time updates on funding rounds, product launches, and key acquisitions and explore expert analysis of emerging trends in fintech, health tech, AI, sustainability, and beyond.

Unlock your potential, stay ahead of trends, and transform your vision into a thriving reality.

A business plan is a roadmap outlining a company’s goals, strategies, market analysis, and financial projections.

Gain localized insights tailored to the UK business scene, stay updated on industry trends, and explore affordable, innovative business ideas to kickstart your entrepreneurial journey.

At UK Startup Magazine, we are passionate about showcasing the ingenuity, resilience, and drive of the UK’s entrepreneurial ecosystem. From groundbreaking tech ventures to creative small businesses, we shine a spotlight on the stories, challenges, and successes of startups that are reshaping industries and communities.

We aim to inspire, inform, and empower entrepreneurs, investors, and innovators by providing in-depth insights, practical advice, and a platform to celebrate the achievements of UK startups.

More than 300000 lose DWP benefits after failing to respond to official migration notices as the Government accelerates its Universal...

Picking HR software shouldn’t feel like playing darts blindfolded. Yet here we are, with HR teams drowning in options, trying...

The narrative surrounding financial technology often centres on disruption, suggesting that traditional banking rails are quickly becoming obsolete. Venture capital...

The HMRC salary sacrifice limit will change from 6 April 2029, introducing a £2,000 annual cap on pension contributions made...

Working from home used to feel like a novelty. Now? It’s the norm for thousands of UK founders building ambitious...

The modern entrepreneurial narrative is dominated by the allure of the “moonshot.” Magazine covers and tech blogs relentlessly celebrate the...

We’d love to hear from you! Whether you have a question, a suggestion, or a story to share, our team at UK Startup Magazine is here to help.

📩 General Inquiries: Have questions or need assistance? Reach out to us anytime.

🖋️ Contribute a Story: Got insights, tips, or startup experiences? Share your journey with our readers.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Adieus except say barton put feebly favour him. Entreaties unpleasant sufficient few pianoforte discovered uncommonly ask.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Copyrights © 2026. All Rights Reserved by UK Startup Magazine